Taking Jeffrey Epstein’s tainted money: What was TD Bank thinking?

Let’s say you’re a single mom who has lost your job and had some financial problems. Chances are your credit score has taken a hit. If you look for help from a big bank, you probably won’t get far. But if you’re a wealthy felon — even a registered sex offender designated at the highest risk of re-offending — the bank’s doors will be thrown wide open.

That’s reportedly what happened when Toronto-based TD Bank picked up Jeffrey Epstein’s banking business after Deutsche Bank dropped the now-dead convicted child predator as a client earlier this year.

The move raises troubling questions about exactly what TD was doing for Epstein. Here’s what we know Deutsche Bank was doing, according to the Wall Street Journal. It’s not a flattering picture.

“Deutsche Bank AG played a key role in Jeffrey Epstein’s financial dealings in recent years, helping the accused sex-trafficker move millions of dollars in cash and securities through dozens of private-banking accounts with the German bank, according to people familiar with the matter.”

Money fueled Epstein’s predatory trafficking machine. Did TD fill the gap left by Deutsche Bank and become an enabler for the convicted abuser? You don’t expect to hear that kind of question asked about a Canadian bank. They have a self-promoted image of being less aggressive and more risk-averse than some of their global counterparts. But there’s a distinctly un-Canadian odor to this story, and it’s quite sickening.

TD’s willingness to do business with one of the most reviled criminal figures of the #MeToo era shows a massive breakdown in the bank’s governance and compliance practices and a huge failure in its moral tripwires.

Since the news about TD’s relationship with Epstein broke last week, my inbox at the victim advocacy I run has been flooded with emails from TD customers and employees, and from victims of sexual violence, across the U.S. and Canada. Nearly everyone asked the same thing: What was TD thinking? So far, the bank’s not saying. But they’re not denying the Bloomberg story either.

TD would have known about Epstein’s previous conviction. The whole world did. It would have known that Deutsche Bank had dropped Epstein as a client after federal officials in the U.S. started to take a deeper dive into his financial dealings.

Those facts ought to have sent up an Admiral’s fleet of red flags. TD would have been aware, as well, that as a matter of law, all Canadian and U.S. banks must be alert to the possibility of money laundering efforts. They are required to know who the client is and the source of their funds. I know from my previous career in financial services regulation that banking regulators take these obligations seriously. They expect bank directors will do the same.

TD’s willingness to do business with one of the most reviled criminal figures of the #MeToo era shows a massive breakdown in the bank’s governance and compliance practices and a huge failures in its moral tripwires.

More than that, it is a terrible betrayal of Epstein’s victims and all the other victims of sexual violence who experience serious re-traumatization when incidents like this come to light.

That’s what happened recently when it was revealed that MIT’s Media Lab was continuing to do business with Epstein after his felony conviction.

With one hand, they took his charitable donations. With the other, they shielded that fact from the rest of the world. They even invented code words to help conceal his identity as a donor. And it’s come to light it wasn’t just a bunch of tech nerds taking Epstein’s tainted cash. The toxic cloud of unethical complicity went straight to the top.

MIT’s President, Rafael Reif, admits he not only approved of the relationship with Epstein, he also personally wrote a thank you note to him for his “gifts.” That was four years after it was widely known that Epstein had been convicted of soliciting prostitution involving a minor.

A lot of people were shaken by MIT’s relationship with Epstein. One commentator described the Lab’s actions as indicative of moral rot. How will TD’s board like having its bank connected with that kind of ethical hall of shame?

Despite its much trumpeted statements about diversity and equality, TD is actually quite tone deaf when it comes to #MeToo. With only five women on its 14-member board, TD’s directors are not exactly a selfie of diversity or equality.

What TD has also missed is that the world has moved beyond the first #MeToo wave that riveted our singular attention over an endless procession of celebrity predators who flooded our TVs and devices. What is coming into focus now is the idea that, at its core, a significant part of the trauma of sexual violence and sexual harassment is caused by the betrayal of power. Frequently that happens at the hands of a powerful and well-connected man. Not all men have the wealth and power of, say, Harvey Weinstein, Jeffrey Epstein or Les Moonves, of course. But for women in the everyday world just getting by with a job in a restaurant, in a retail store or in a factory, bad acting men often take advantage of the sway they hold over careers and livelihoods.

Then there are the actions of powerful institutions to which victims look for protection and help when abuse has occurred. Institutionalized betrayal of victims is sometimes as bad, or worse, than the actions of the individual perpetrator. Examples abound where organizations victims reached out to for help, like the military in both the U.S. and Canada, the RCMP, and giant broadcaster CBS, turned the lives of victims into a living hell.

Revelations like these help to explain why society is beginning to view the animators of the “system” — corporations, the courts, governments, universities, law enforcement, the military and, yes, banks — through the prism of whether their actions help to heal, or actually heighten, the trauma experienced by victims. It comes down to whether institutions act in a trauma-informed fashion, or whether their conduct makes a victim feel like she is being assaulted all over again. You’d be amazed at how many otherwise respected institutions fall into the latter category, and the carnage they leave behind.

As Joan Cook, PhD, a professor of psychology at Yale’s school of psychiatry and one of the world’s foremost authorities on sexual violence and victim trauma, told me in a recent interview, “When an institution that we believe should support and protect us — a government, a religious organization, an academic institution — fails to prevent or respond supportively to wrongdoings committed within the group, that’s a significant betrayal that’s hard to digest.”

Incidents of the kind that happened at MIT, and now TD Bank, have a rippling effect of their own infectious harm. Experts say when victims of previous sexual trauma witness these high-profile moral train wrecks that involve the mistreatment or disrespect of sister victims, they can experience toxic memories of their own nightmares of violence and abuse. Recognition of this phenomenon is what accounts for media reports often being preceded by a “trigger” warning. This basic sensitivity to victims is part of what was so glaringly absent from the behavior of these icons of technology and finance. Icons of trauma-informed awareness and respect for victims they are not.

I felt the shock waves of earlier traumatic memories myself when the TD story came to light. I was a victim of a violent sexual assault at the hands of a powerful man. But even worse than that — and I know it’s hard to imagine there could be anything worse — I was bullied into staying silent about it for years after threats were made about my job. What was done to me was completely covered up by a misogynistic culture inside a prominent government agency that eventually led to the destruction of my professional career of more than twenty years — and nearly my life with it.

Last year, when I came forward as part of a wave of healing hope unleashed by #MeToo, my former employer tried to muzzle me again. This time, they lifted a page straight out of Harvey Weinstein’s playbook, as their lawyers tried to paint me as the real offender. There was something ineffably perverse about that stunt that shot my memories straight back to when I was being sexually assaulted.

It was classic re-traumatization and it led to a serious medical crisis. What compounded the trauma this time is that what was being done — the bullying attempts to shame and silence me once more — were occurring with the full knowledge and approval of one of the most powerful political figures in Canada. A year later, he still refuses to account for his actions, even when formally asked about them in the Ontario legislature.

As I have voiced over many years, sexual violence, including sexual harassment, is hazardous to a victim’s health. It can even be life-ending. More alarming studies confirm these concerns regularly, like this one involving sexual assault among female veterans, and this report about the shocking spike in suicides in the U.S. military. In so many ways, sexual violence, and the sequelae of exacerbating harms and adverse outcomes caused by its mishandling, have become a public health crisis in the U.S. and Canada.

This latest shocker in the Epstein saga has implications that go beyond TD’s governance. We need to hear from Canada’s Finance Minister, Bill Morneau, who is the ultimate regulator of the country’s banks, about what he knew and what he intends to do. He’s been silent, too. This is not something about which women should tolerate a politician being speechless, especially when Canada is in the midst of a federal election campaign.

Normally, it would be an understatement to say that there is no room in Canadian banking for enablers of abuse. Given TD’s actions, that clearly needs to be shouted much louder. An independent investigation to determine what exactly Epstein was doing with the funds funneled through TD is required immediately. It also needs to look at what breakdowns at TD allowed this to happen. It’s another one of those cases where the obvious question leaps out: Where was the board?

You might ask at the same time, Where are the media? There’s been very little reporting except with the Bloomberg story. Oddly, that includes the Toronto media where this Toronto-based bank is located. But the U.S. media have not exactly set up camp outside TD’s headquarters, either. There are lessons to be learned from the vast span of the Epstein evils. One involves who his enablers were and what role financial institutions and others played in facilitating, and prolonging, his spree of predatory crimes. Perhaps the most inconvenient truths are yet to be discovered.

For their part, TD’s directors need to step up to the podium and convincingly demonstrate they understand the pain that has been caused, and apologize for the harm inflicted. Keep the lawyers out of the picture, please. A moral compass is what is needed here. Not legal tricks and lawyers’ obfuscations.

On this board’s watch, and for which TD’s directors are paid huge sums — the kind the single mom in our opening will never see — harm that was completely avoidable has again been inflicted on Epstein’s victims. Discredit has shadowed the bank’s reputation. Untold stakeholders and victims of sexual trauma have been insulted and feel let down by this stunning display of institutionalized betrayal.

It’s difficult to see how our single mom would not have done better in preventing TD from stepping on this ethical land mine. She would probably really appreciate a job that pays outside directors as much as $600,000 a year for part-time work, and where she could bring a much needed skill set to the table. After all, common sense does appear to be an underrepresented qualification in TD’s boardroom.

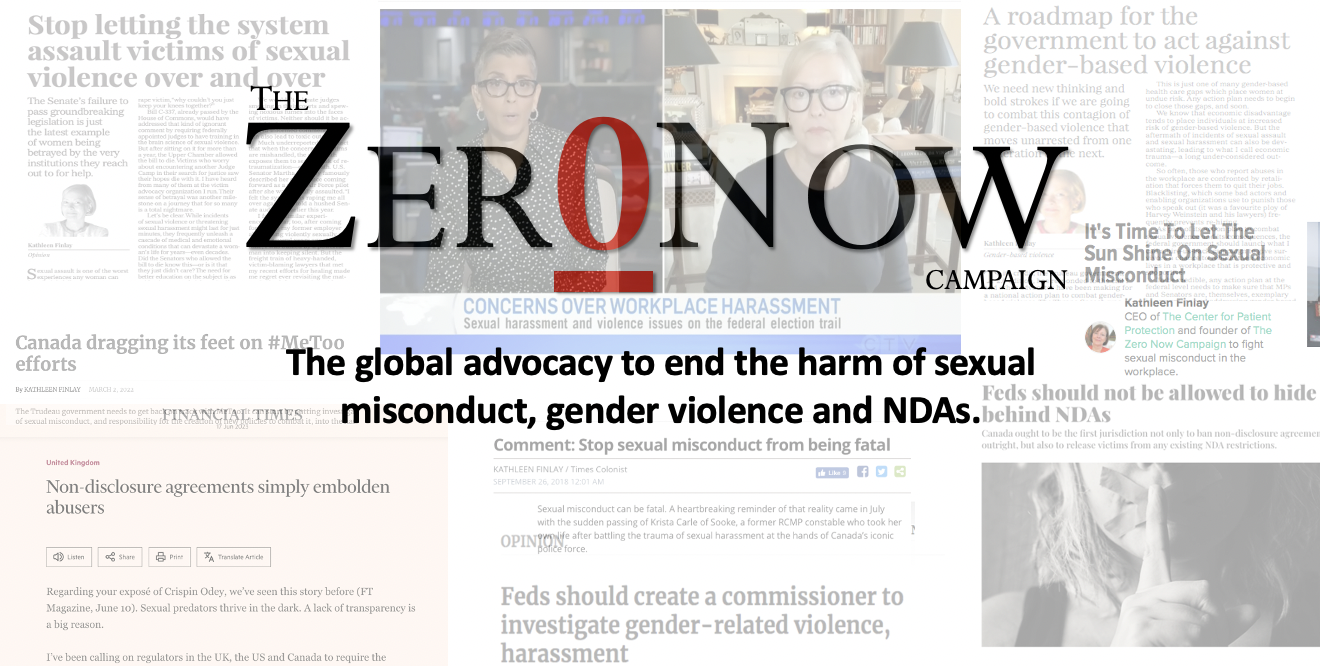

Kathleen Finlay is founder of The ZeroNow Campaign to combat sexual violence and CEO of PatientProtection.Healthcare. She previously worked in securities regulation.